Commercial Real Estate is Witnessing a Migration from Office Ownership to Other Industries

With the shifts in economic and professional fields occurring, a migration is developing. A growing percentage of commercial real estate investors and portfolio holders are now expanding their focus from office development to include residential acquisitions.

Mentioned in a recent Wall Street Journal article, the move is already happening. Data and sources from the editorial highlight that this migration is most prominent in the US on the East Coast; massive office buildings have struggled with occupancy in the nearly-three-years since the pandemic hit.

As remote work has become more commonplace, building proprietors are having a hard time padding premium spaces that were competitive prior to March 2020. And as the workforce has received the advantage of choosing their desired environment, companies are much more comfortable with remote operations and permit Zoom-led collaboration in efforts to retain their top employees.

This current job market status is emptying offices, but many large-scale investors and owners are finding ways to fill the vacancies via the residential housing market and other creative solutions.

By now, many experts nationwide have agreed that the housing market is in a state of pressurized flux – with stabilization, deceleration, and crash all considerable possibilities. Mixed variables like mortgage rates, inflation adjustments, general home prices, wage modifications, and rental costs complicate predictions.

Large tower and property managers anticipate a unique opportunity that is cresting the horizon: by retrofitting current office spaces for new types of tenants, owners are using commercial spaces for residential and professional reasons as a fiscal way to repurpose assets.

A big name in the commercial space is already developing next-step plans: Boston Properties Inc. “As the largest publicly traded developer, owner, and manager of premier workplaces in the United States” Boston Properties Inc. is partaking in the migration. The sizable corporation is finding ways to develop and redevelop along the East Coast, with a goal of holding 2,000 residential units.

Building, remodeling, or buying real estate for non-office use is the new focus for many organizations. Living spaces are in high demand, particularly in urban populaces; profitable opportunities can be realized as physical work stations become less occupied.

Although the cost is up-front to retrofit and repurpose office property, many portfolio managers are seeing the benefit in taking this initial step. The goal of procuring large commercial real estate is to fill it with occupants – whether that be for office, residential, or other professional use.

This has led to an expansion from solely-office-space-usage into other functions and industries. Some have altered their buildings for unique transitions, like art or photography studios, professional training services, or hosting private events. Others still have branched out into the world of entertainment, transforming their assets into operational auditoriums, health clubs, and even casinos.

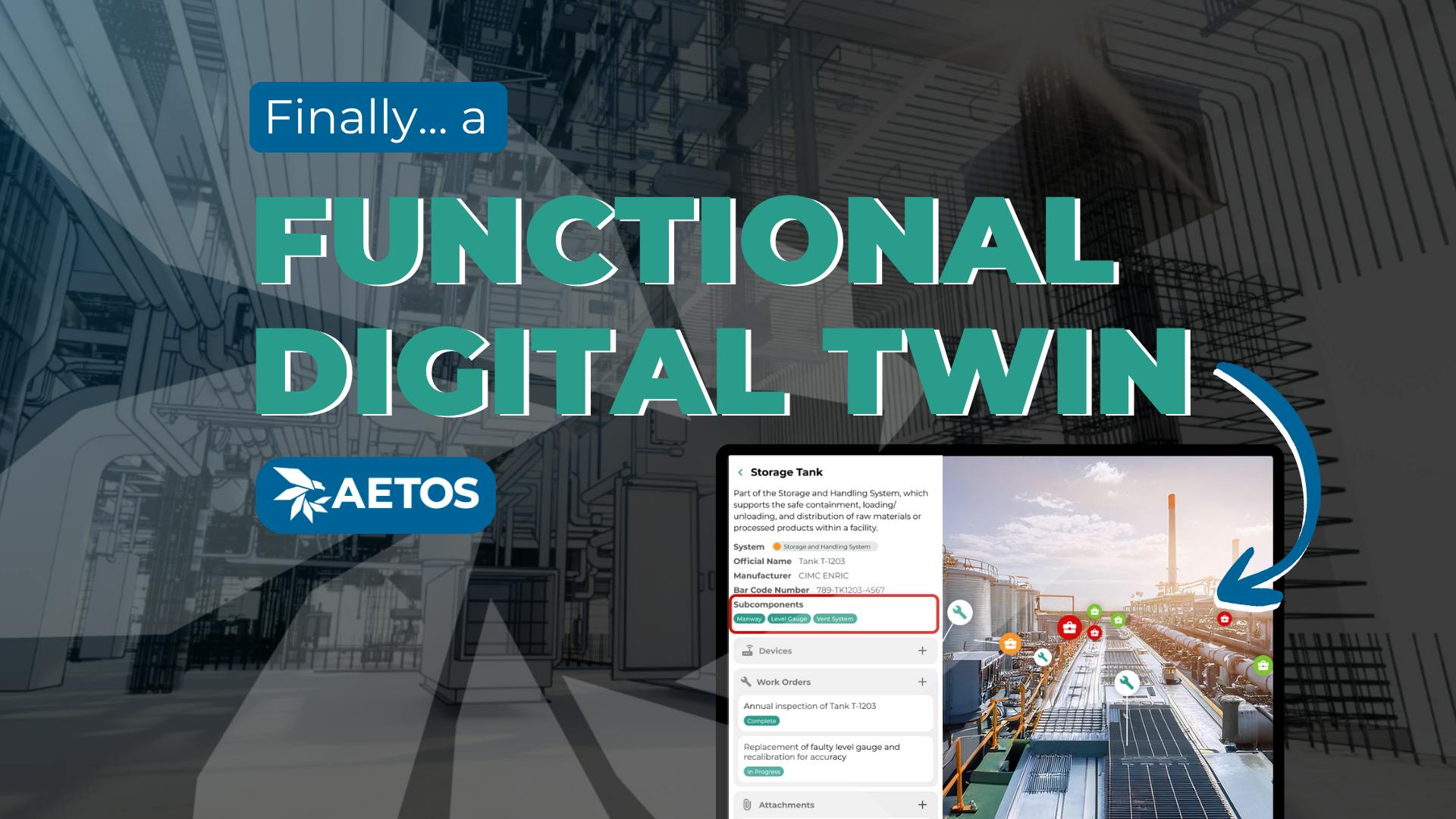

Right now, Aetos Imaging is providing building owners a way to visually capture their properties and the critical spaces therein. Digital twin technologies allow decision makers to view their assets in a 3D environment, display current machinery and equipment, plan alterations, collaborate virtually with investors or project managers, and in so doing, greatly expedite projects. Furthermore, should an acquisition be made, the asset is considerably more valuable if the inheritance is accompanied with a digital twin – complete with a training database, hyper-visual representation, maintenance history, and more.

The future of commercial real estate may or may not manifest a return to office space usage. In the meantime, many building owners are doubling down on reusing their properties: knowing that housing needs will be relevant and ubiquitous for years to come, while new business expeditions could yield profit in the foreseeable future. Capturing a digital twin could be invaluable in the years to come.